China will pass the US in total broadband lines by the third quarter of 2006 to have the largest subscriber base in the world (see Figure 1). The US and China are followed by Japan, South Korea, Germany, and France in total broadband lines per country.

Broadband Line Growth by Country – Q405 – Q206

Figure 1: Broadband Line Growth by Country – Q405 – Q206

Source: Point Topic and Website Optimization

China’s growth rate of 12.6% per quarter was over twice that of the US at 5.4%. From Q1 to Q2 2006, China added over 5.1 million broadband lines, compared to the US adding 2.5 million lines (see Figure 2). Chinese broadband growth increased over the previous quarter from 9.8% to 12.6%, where the US failed to keep up with the 3.3 million lines added in Q1 2006.

Top 10 Countries in Broadband Lines Added Q12006 – Q22006

Figure 2: Top 10 Countries in Broadband Lines Added Q12006 – Q22006

Source: Point Topic

Top 10 Broadband Countries by Number of Lines

The US lead over China has dwindled from 8.4 to 4.4 million broadband lines from Q2 2005 to Q2 2006. As of Q2 2006 the US had 50.8 million lines, while China came in second place with over 46 million lines. With its large population and lower broadband saturation China has a higher growth rate than the top three countries and is poised to overtake the US in total broadband lines. Between Q2 2005 and Q2 2006 China added over 15 million broadband lines, a growth rate of 48%. Meanwhile the US added 11 million lines with a growth rate of 27.6% (see Figure 3).

Top 10 Countries in Broadband Penetration by Lines

Figure 3: Top 10 Countries in Broadband Penetration by Lines

Source: Point Topic

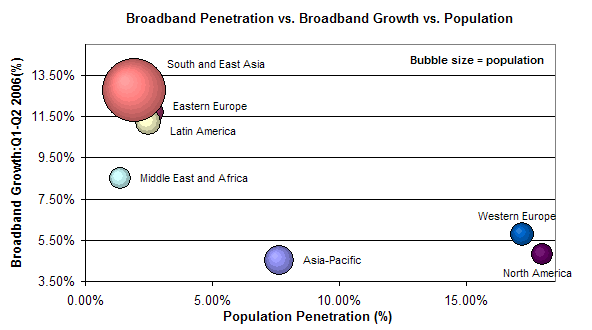

The Effects of Market Saturation

As the market adoption of a technology increases, its growth rate naturally decreases. So as markets get more saturated, a lower percentage of the population is able to adopt new technologies. We’re seeing this effect in worldwide broadband penetration rates (see Figure 4). North America and Western Europe lead the world with 18% and 17% broadband penetration by population respectively but have growth rates below 6%. Meanwhile South and East Asia, Eastern Europe, and Latin America show higher growth rates but lower saturation levels. Asia-Pacific came in third at 7.6% penetration.

Broadband Penetration vs. Broadband Growth vs. Population

Figure 4: Broadband Penetration vs. Broadband Growth vs. Population

Source: Point Topic

Broadband Growth Over the Past Quarter

Greece tops the list of countries surveyed with more than 100,000 lines at 44.4% growth (see Figure 5) over the past quarter. India came in second at 33.3%, Columbia at 23.8%, South Africa at 23.7%, Vietnam at 21%, Croatia at 19.9%, Philippines at 18%, Argentina at 17.9%, Czech Republic at 15.5%, and Romania at 15.1%. In year-on-year rankings India topped the list with a 289% growth rate, followed by Greece at 237%. India’s broadband growth was fueled by fast DSL growth boosting the total number of DSL lines to 1.3 million.

Top 10 Broadband Countries by Growth – Q12006 – Q22006

Figure 5: Top 10 Broadband Countries by Growth Q12006 – Q22006

Source: Point Topic

Broadband Penetration by Household

Overall, South Korea led all countries surveyed with 85.1% of all households subscribed to broadband. Iceland came in a close second with 85% penetration, followed by Hong Kong at 81.5%, and Monaco at 75.7% (see Figure 6).

Top 10 Broadband Countries by Household Penetration

Figure 6: Top 10 Broadband Countries by Household Penetration

Source: Point Topic

Broadband Growth Trends in the UK

In the UK, Point Topic predicts that broadband penetration will nearly double by 2008, fueled by the rapid adoption of DSL-based broadband (see Figure 7).

Broadband Growth Trends in the UK

Figure 7. Broadband Growth Trends in the UK

Source: Point Topic

A geographic forecast map of broadband penetration by household shows that penetration will nearly double, from 34% at the end of 2005 to 64% three years later (see Figure 8). As the map shows, the remote rural areas where penetration is lowest today (dark red on the map) will grow fastest and catch up with the rest of the country. But the highest take-up will continue to be in prosperous areas of the South East of England. By end-2008 between 80% and 90% of homes will have broadband across a large part of the South East (dark green on the map).

Broadband Growth Trend Map for the UK

Figure 8. Broadband Growth Trend Map for the UK

Source: Point Topic

Home Connectivity in the US

US broadband penetration among active Internet users grew to 76.33% in September 2006. Narrowband users connecting at 56Kbps or less now comprise 23.67% of active Internet users, down 1.46 percentage points from 25.13% in August 2006 (see Figure 9).

Web Connection Speed Trends – Home Users (US)

Figure 9: Web Connection Speed Trends – Home Users (US)

Source: Nielsen//NetRatings

Broadband Growth Trends in the US

In September 2006, broadband penetration in US homes grew 1.46 percentage points to 76.33%, up from 74.87% in August. This increase of 1.46 points is above the average increase in broadband of 1.1 points per month over the last six months (see Figure 10). At current growth rates US broadband penetration should break 80% among active Internet users by December 2006.

Broadband Adoption Growth Trend – Home Users (US)

Figure 10. Broadband Adoption Growth Trend – Home Users (US)

Extrapolated from Nielsen//NetRatings data

Work Connectivity

As of September 2006, 91.42% of US workers were on broadband, up 0.21 percentage points from the 91.21% share in August. At work 8.58% connect at 56Kbps or less (see Figure 11).

Web Connection Speed Trends – Work Users (US)

Figure 11: Web Connection Speed Trends – Work Users (US)

Source: Nielsen//NetRatings

Further Reading

- China will pass US in Broadband Lines by late 2006 – Worldwide Broadband Survey

- A previous prediction based on data from Telecompaper. China will pass the US in total broadband subscribers by the end of 2006.

- Nielsen//NetRatings

- Provided the US broadband penetration data for active Internet users for the Bandwidth Report.

- Point Topic

- Provided the worldwide and UK broadband data and forecasts.